What’s New that you need?

Portfolio analysis requires a number of analytics for insight. Analytics used include known objective/quantitative analytics such as:

- Assessing risk levels

- Return on investment (ROI)

- Market trends

- Strategic fit

Newer analytics that include subjective criteria, path to point relationships analysis, updated ranking algorithms, neural net influence determinations and other techniques are now part of portfolio analysis.

A Simple Example:

Ranking the members of a portfolio today involves the use of multi criteria decision making techniques.

This example shows an ensemble of such analytics to create a priority list of a suite of projects for an organization. The analytics used to sort out the criteria were:

- A composite multi criteria ranking to show which criteria are most significant

- A correlation matrix to show if any of the criteria move together

- A neural net analysis to identify the most influential criteria

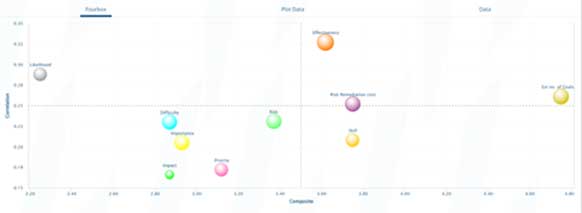

From the three rankings a 4 - box can be prepared. This 4 – Box represents the 3 sets of the criteria ranking results. The most significant criteria are in the upper right quadrant.

Here is what is displayed:

- Vertical axis is correlation

- Horizontal is composite ranking

- Mouse over the bubble to get influence

The upper right quadrant has criteria that have high correlation and high rank. To see the influence you would mouse over the bubble. This is a high value quadrant.